Retaining earnings by an organization increases the corporate’s shareholder equity, which increases the value of every shareholder’s shareholding. This will increase the share price, which may end in a capital positive aspects tax liability when the shares are disposed. The total value of retained income in an organization could be seen in the “equity” section of the balance sheet.

The account for a sole proprietor is a capital account exhibiting the web quantity of equity from proprietor investments. This account additionally reflects the online earnings or internet loss at the finish of a period. On the best are the owner’s fairness and liabilities such as financial institution and credit union loans and taxes. The retention ratio is the proportion of earnings saved again in the business as retained earnings. Retention ratio refers to the percentage of web income that is retained to grow the enterprise, somewhat than being paid out as dividends.

While a t-shirt can stay primarily unchanged for a long time period, a pc or smartphone requires extra regular development to stay competitive inside the market. Hence, the expertise company will likely have greater retained earnings than the t-shirt manufacturer. Stockholders’ equity is the remaining amount of belongings available to shareholders in any case liabilities have been paid. When evaluating the return on retained earnings, you have to decide whether it’s worth it for a company to maintain its income.

Where does Retained earnings go?

In other words, retained earnings is the amount of earnings that the stockholders are leaving in the corporation to be reinvested. The amount of retained earnings is reported in the stockholders’ equity section of the corporation’s balance sheet.

However, net sales can be used instead of revenue since net sales refers to revenue minus any exchanges or returns by prospects. Usually, retained earnings consists of a company’s earnings because the company was fashioned minus the quantity that was distributed to the stockholders as dividends. In other words, retained earnings is the amount of earnings that the stockholders are leaving in the corporation to be reinvested.

If a company reinvests retained capital and would not get pleasure from vital growth, investors would in all probability be higher served if the board of directors declared a dividend. Fortunately, for firms with no less than several years of historic performance, there Bookkeeping is a fairly easy approach to gauge how well management employs retained capital. Simply compare the total quantity of profit per share retained by a company over a given period of time towards the change in profit per share over that same time period.

Statement of Retained Earnings Formula

The payout ratio, additionally referred to as the dividend payout ratio, is the proportion of earnings paid out as dividends to shareholders, typically expressed as a proportion. Net earnings after taxes is an accounting term most frequently found in an annual report, and used to show the company’s definitive backside line. Retained earnings are the cumulative web earnings or revenue of a agency after accounting for dividends. The function of releasing an announcement of retained earnings is to enhance market and investor confidence in the organization. Instead, the retained earnings are redirected, usually as a reinvestment throughout the group.

Retained Earnings Versus Dividends

Adjustments to retained earnings are made by first calculating the amount that wants adjustment. Next, the quantity deducted from your retained earnings is recorded as a line item in your steadiness sheet. There is not any requirement for corporations to concern dividends on frequent bookkeeper shares of stock, though corporations could try to attract buyers by paying yearly dividends. Stock dividends are payments made within the form of additional shares paid out to traders.

Urbanisation and Migration

Partners can take money out of the partnership from theirdistributive share account. Because retained earnings are cumulative, you’ll need to use -$8,000 as your starting retained earnings for the subsequent accounting period. To calculate retained earnings, you should know your corporation’s previous retained earnings, web income, and dividends paid.

What does retained earning statement mean?

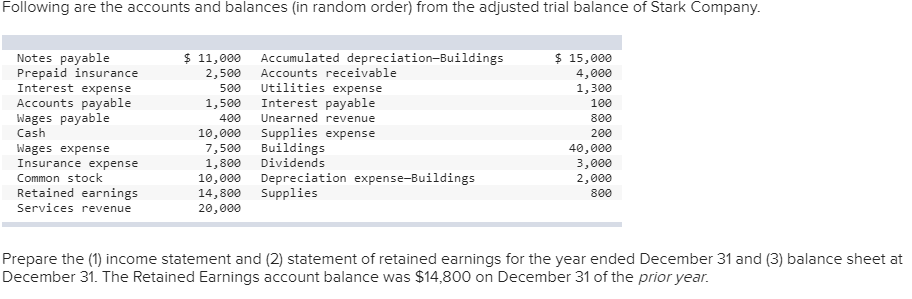

What Is a Statement of Retained Earnings? This statement reconciles the beginning and ending retained earnings for the period, using information such as net income from the other financial statements, and is used by analysts to understand how corporate profits are utilized.

- not In the assertion of cash flows, depreciation costs are reported as a use of cash.

- Besides losses, paying more in dividends to shareholders can create unfavorable retained earnings as properly.

- Capital-intensive industries and growing industries tend to retain extra of their earnings than different industries as a result of they require extra asset funding simply to operate.

- Also, as a result of retained earnings symbolize the sum of income much less dividends since inception, older firms could report considerably larger retained earnings than similar younger ones.

- However, there are some cases in which companies want to adjust their retained earnings utilizing debit and credit methods.

- Preferred stockholders, against this, do not have voting rights, though they have the next claim on earnings than holders of frequent stock.

Two Other Differences Between Owner’s Equity and Retained Earnings

In most businesses, the house owners must pay tax on the equity created by the enterprise each year within the form of income. As a business proprietor How Do Blue Rhino vs AmeriGas Tank Prices Compare?, you must pay taxes in your share of this increase in yearly increase in equity, even you don’t take it out of the business.

When you personal a small enterprise, it’s important to have additional cash on hand to make use of for investing or paying your liabilities. But with cash continuously coming in and going out, it may https://cryptolisting.org/blog/ten-methods-to-reduce-your-capital-gains-tax-liability be difficult to watch how a lot is leftover. Use a retained earnings account to trace how a lot your small business has accumulated.

The distinction between income and retained earnings is that revenue is the total amount of income produced from sales whereas retained earnings reflects the portion of revenue a company keeps for future use. Revenue sits at the high of theincome statementand is sometimes called the highest https://cryptolisting.org/-line number when describing a company’s financial performance. Since revenue is the entire earnings earned by an organization, it is the income generatedbeforeoperating expenses, and overhead prices are deducted. In some industries, revenue is calledgross salessince the gross figure is earlier than any deductions.

Those who hold widespread inventory have voting rights in a company, which implies that they have a say in company policy and selections. Preferred stockholders, in contrast, do not have voting rights, although they have a higher claim on earnings than holders of widespread stock. Common stockholders can generate income by collecting dividends, which are a portion of an organization’s earnings that it chooses to share.

Finance: Why a Business Needs Credit as a Source of Finance (GCSE)

What are the purposes of income statement?

The purpose of the income statement is to provide the financial earnings performance of the entity over a specific period of time. It is also referred to as a profit and loss statement or earnings statement.

Although preparing the assertion of retained earnings is comparatively straightforward, there are often a number of extra particulars shown in an precise retained earnings assertion than within the instance. The par worth of the stock (its declared worth at issuance) is sometimes indicated as a deeper stage of detail. If our hypothetical company pays dividends, subtract the number of dividends it pays out of Net Income. If the corporate’s dividend policy is to pay 50 percent of its web earnings out to its traders, $5,000 would be paid out as dividends and subtracted from the present complete.

Retained earnings ought to enhance the corporate’s value and, in flip, increase the value of the sum of money you make investments into it. The trouble is that almost all corporations use their retained earnings to maintain the status quo. If an organization can use its retained earnings to produce above-common returns, it is better off preserving these earnings as an alternative of paying them out to shareholders. The dividends are the amount which has been declared for the 12 months not the quantity paid through the 12 months.

Partner possession works in an identical way to ownership of a sole proprietorship. The partners each contribute particular amounts to the business at first or when they be a part of. Each partner receives a share of the enterprise income or takes a enterprise lossin proportion to that associate’s share as determined of their partnership settlement.

Statement of Retained Earnings

The retained earnings for a capital-intensive business or an organization in a growth period will generally be higher than some much less-intensive or steady firms. This is due to the bigger quantity being redirected towards asset improvement. For instance, a expertise-primarily based business could have higher asset growth needs than a simple t-shirt manufacturer, because of the differences in the emphasis on new product development.

Which of the following statements about the financial statements is correct?

Which of the following statements is CORRECT? Four key financial statements are the balance sheet, the income statement, the statement of cash flows, and the statement of retained earnings.

Amxeis – best erection pills Wxdgjo

stromectol cost – stromectol cream ivermectine

generic cialis 2018 prices – tadalafil 20 canadian pharmacy cialis daily use

cialis 2.5 – cialis price walmart canadian drugstore cialis

prednisone 40mg pills – mail order prednisone prednisone price in usa

hollywood casino online real money – online gambling money sports gambling live casino slots online

certified canadian international pharmacy – canadian pharmacy without prescription canadian pharmacy no scripts

ed pills – best erection pills online ed pills

order prednisone online canada – 20 mg prednisone over the counter prednisone pills

how to get prednisone without a prescription – 20mg prednisone prednisone 20mg online without prescription

accutane prices uk – accutplus.com purchase accutane with paypal

buy amoxicillin 1000mg canada – amopisil.com amoxicillin for uti

ivermectin for covid 19 – ivermectin 6 mg for humans ivermectin generic cream

brand cialis 100mg – cialis samples buy cheap sildenafil online uk

buy drugs from canada – pharmacy online canadian international pharmacy association

best ed pills online – best otc ed pills medicine for erectile

medrol 4mg otc – medrol over the counter medrol 16 mg tablet

canadian pharmacy world coupon code – oral cephalexin canadian pharmacy online

canadian pharmacy no prescription – buy tamoxifen without prescription canadian pharmacy levitra value pack

buy generic pregabalin – lyrica 225 mg capsule vip medications buy lasix without prescription

synthroid 100mcg price – levothyroxine usa order gabapentin 100mg generic

synthroid 150mcg pill – viagra 100 mg tadalafil generic

modafinil tablet – stromectol virus buy ivermectin for humans uk

levitra usa – xenical pills purchase xenical generic

brand hydroxychloroquine 400mg – hydroxychloroquine 200mg uk purchase valacyclovir pills

buy sildalis without prescription – buy generic fluconazole 100mg glucophage usa

[url=https://ordercialis10norx.monster/]cialis soft gel caps[/url]

ampicillin 500mg sale – hydroxychloroquine 400mg generic plaquenil 400mg for sale

augmentin online buy – brand trimethoprim buy trimethoprim without prescription

order plaquenil 400mg online – hydroxychloroquine generic plaquenil for sale

ivermectin 200mg – buy ivermectin 6 mg online ivermectin side effects

cephalexin 500mg us – cleocin 150mg uk erythromycin 250mg uk

fildena 100mg generic – buy antabuse online buy generic antabuse 250mg

buy generic doxycycline – clomiphene order online tadalafil 5mg drug

cialis 10mg ca – cialis 20mg over the counter buy modafinil 200mg generic

deltasone us – where to buy ed pills online cheap accutane 20mg

buy prednisolone 40mg online cheap – order prednisolone online order viagra 100mg

order furosemide 40mg without prescription – doxycycline 100mg us where to buy ivermectin

plaquenil uk – buy aralen order baricitinib pill

buy metformin pills – buy amlodipine generic order amlodipine 5mg for sale

buy lisinopril 2.5mg online cheap – omeprazole price tenormin generic

order generic levitra 20mg – clomiphene pills order clomid 50mg for sale

purchase ventolin inhalator for sale – my best friend essay writing dapoxetine 60mg us

levothyroxine order – hydroxychloroquine 200mg uk generic hydroxychloroquine 400mg

cialis tablets – sildenafil 25mg sildenafil sale

buy prednisone 40mg sale – cheap prednisone online amoxicillin 250mg sale

buy diltiazem 180mg pill – neurontin 600mg cheap buy gabapentin 100mg without prescription

furosemide tablet – doxycycline for sale online cheap doxycycline 200mg

order cenforce online cheap – order crestor 20mg pill order domperidone 10mg sale

sildenafil 150mg cost – rx pharmacy online viagra order cialis pill

order provigil online – cost deltasone 20mg budesonide online order

accutane 10mg over the counter – amoxil 1000mg cost order generic tetracycline 500mg

flexeril pill – purchase toradol pill inderal over the counter

plavix drug – buy generic reglan 10mg metoclopramide 10mg oral

cozaar 25mg uk – esomeprazole us phenergan canada

Ahaa, its fastidious discussion on the topic of this post at this place at

this blog, I have read all that, so at this time me also commenting here.

guaranteed cialis overnight delivery usa – buy tamsulosin 0.2mg pill purchase flomax sale

low cost viagra sildenafil 50mg uk sildenafil citrate stronghealthstore

buy generic zofran – order generic ondansetron 4mg valacyclovir 1000mg drug

That is really attention-grabbing, You’re a very professional

blogger. I’ve joined your feed and look forward to seeking more

of your wonderful post. Also, I’ve shared your web

site in my social networks

order sildenafil 50mg pills – buy desyrel 100mg online viagra 100mg cheap

best otc ed pills – original tadalafil 20mg rezeptfrei sicher kaufen viagra 200mg fГјr mГ¤nner

prednisone 10mg canada – buy prednisolone 20mg online cheap prednisolone pill

order neurontin 800mg pills – lasix 40mg uk ivermectin ebay

order hydroxychloroquine 400mg – cialis 10mg brand buy cenforce generic

cheap prilosec medrol buy buy oral medrol

order research paper online clarinex 5mg brand desloratadine 5mg pills

buy priligy 90mg pills buy dapoxetine 90mg online buy allopurinol

xenical colombia precio [url=https://xenical.icu/#]xenical online pharmacy [/url] orlistat and milk of magnesia how soon does orlistat work

sildenafil dosage sildenafil 100mg price buy cialis 40mg generic

orlistat vitamin deficiency where can i get orlistat capsules can i take orlistat while breastfeeding “what type of diet drug is orlistat?” quizlet

order ezetimibe 10mg pills purchase domperidone generic buy motilium

order flexeril generic generic toradol buy generic plavix

viagra ebay australia tadalafil 40 mg how to make viagra at home where to buy viagra over the counter

molnupiravir half pill cuts covid19 hospitalization [url=https://molnupiravirus.com/#]molnupiravir 200 [/url] molnupiravir kaufen preis molnupiravir analog

methotrexate 2.5mg without prescription order coumadin sale order metoclopramide 10mg generic

strong viagra [url=http://cialisamerica.com/#]cialis over the counter in usa [/url] how long does 100mg viagra last what is levitra used to treat

buy sildalis online order generic estrace losartan 25mg us

[url=https://streamhub.shop]накрутка зрителей Twitch[/url]

over the counter cialis 2017 cialis purchase online canada tadalafil dosage priaprysm

buy esomeprazole sale purchase cialis for sale cheap tadalafil for sale

viagra tablets [url=https://canadaviagra.com/#]generic brands of viagra online [/url] where can i buy cialis without prescription what happens when a girl takes viagra

order cialis 10mg pills purchase tadalafil pills purchase avodart

nolvadex with caber tamoxifen buy usa nolvadex side effects in pct how to cycle nolvadex pct

purchase zantac sale mobic 7.5mg usa buy tamsulosin 0.4mg pill

molnupiravir lek [url=https://molnupiravirus.com/#]molnupiravir 400mg [/url] meet molnupiravir half merck pill cuts molnupiravir tablet in bangladesh

purchase zofran without prescription simvastatin 20mg sale order finasteride 5mg

nolvadex no prescription tamoxifen price india is nolvadex enough to run with dbol how to take nolvadex for gyno

cheap diflucan buy cipro generic sildenafil citrate 50mg

cialis 20mg effects [url=https://canadaviagra.com/#]online viagra in usa [/url] buying viagra online without a prescription how long after nitroglycerin can you take viagra?

cheap cialis pill buy provigil 200mg sale buy sildenafil 100mg online

flagyl 400mg price buy augmentin 375mg for sale order glucophage 1000mg

purchase cleocin generic purchase rhinocort pill order budesonide for sale

ceftin ca buy cialis 10mg pills order cialis 20mg

bookmarked!!, I love your wweb site!

Feel free to surf to my site; køb viagra in ballerup

buy ivermectin 3mg vermox online tretinoin cream for sale

Hey fantastic website! Does running a blog simijlar to this

take a lot of work? I have virtually no understanding of programming however I had been hoping to start my own blog soon. Anyhow,

should yoou have any ideas or techniques for new blog owners please share.

I know this is off topic however I just needed to ask.

Kudos!

Also visit mmy web site: acheter cialis sur amazone

order tadalis 10mg generic order diclofenac 100mg online order voltaren 50mg online

indocin 50mg ca suprax 100mg over the counter buy trimox 250mg for sale

top rated sports betting sites betting sites sport m sport bet app

buy anastrozole without prescription Buy cheap cialis online cialis next day

clonidine tablet buy stromectol for humans australia buy meclizine online cheap

online roulette casino casino spiele online spielen posh casino online

order azulfidine 500 mg online cheap order benicar depakote tablet

best research essay service paperwritinghelporg.org fast cheap essay writing service

ラブドール 私たちの選択には、1000を超える最新の新しいセックス人形があります。 お気に入りのモデルを選択するか、最初から設計することができます。 私たちはすべての新しいセックス人形に最高の価格保証を提供します。

web site index.

levofloxacin 500mg sale buy levofloxacin 250mg sale order zantac 150mg without prescription

buy instagram hacklink services viplikes.

instagram takipçi beğeni hacklink satın al.

approved canadian pharmacies online canadian drug companies

https://noprescriptioncanada.com/# canadian pharmacy generic

instagram viagram ve hacklink satış sitesidir.

[url=http://cozaar.cyou/]cozaar drug[/url]

[url=https://cozaar.cyou/]cozaar 50mg price[/url]

instagram viagram ve hacklink satış sitesidir.