The downside is that these features are only available as an add-on to the top-tier plan. Like Xero, you can keep track of all unpaid bills in Spendwise. This includes entering bills with their due dates and printing checks to pay them on time. You can also stay on top of open accounts payable balances by running an accounts payable aging report.

Some of the most common purchase motivations for accounting software are to increase functionality (43%), replace an outdated system (29%), and improve the usability normal balance of their accounting system (17%). By considering these factors, you will easily be able to narrow down what types of accounting software features you’ll be needing.

They got the tax prep for FREE for the services of LLC setup they got with legal zoom. You’re better off contracting with a CPA for your taxes and seeing if they also offer bookkeeping services or can recommend a reputable bookkeeper as well. The $2000 charge is a Subscription Package that includes Advisory, Tax Prep for Business and Personal, similar to a gym membership with access and services that the client needs to use. The Client is still entitled to use the servicestaht they paid for Business Tax Prep and Personal Tax Prep for the 2019 Tax Year even if their subscription ends.

The price, features and usability of FreshBooks make it one of the best accounting solutions on the market. B2B & SaaS market analyst and senior writer for FinancesOnline. He is most interested in project management solutions, believing all businesses are a work in progress. From pitch deck to exit strategy, he is no stranger to project business hiccups and essentials.

Start Your Business

Hiring a lawyer is another option, but will often cost you hundreds, if not thousands, of dollars. Nolo’s Online LLC formation service can complete all of the paperwork and filings for you, with packages starting at just $49. Every LLC must have an agent for service of process in the state. This is an individual or business entity that agrees to accept legal papers on the LLC’s behalf if it is sued. Your LLC cannot serve as its own agent to accept such papers—it must designate a third party.

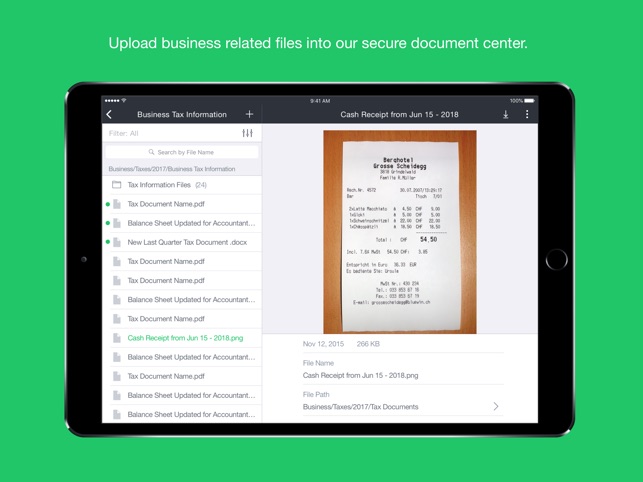

These Ledgers include balance sheets and income statements. They also record financial transactions in the form of debits or credits in the ledger, as well as create financial reports. Our bookkeeping cutting-edge technology offers a comprehensive suite of services. Access your Bookkeeper at any time through your secure message center, and easily track your mileage using our mobile app.

The Advanced plan supports 10 or more users (up to 25 users) and costs $45 per month.Unlike the other plans, there isn’t a free trial option with this plan. In addition to the features included in the https://www.bookstime.com/articles/1-800accountant Plus plan, you receive Smart Reporting powered by Fathom, five online QuickBooks classes to train your team and premium customer support. You’re also assigned a dedicated customer success manager.

How many years can a LLC claim a loss?

As the owner of a single-member LLC, you don’t get paid a salary or wages. Instead, you pay yourself by taking money out of the LLC’s profits as needed. That’s called an owner’s draw. You can simply write yourself a check or transfer the money from your LLC’s bank account to your personal bank account.

Zoho Books Tiered Pricing & Features Table

With our help, you can get back to what you love – running your business. A bookkeeper is a person employed to keep the records and financial affairs of a business. Bookkeepers are responsible for some (or all) of an organization’s financial information, which is generally known as the General Ledger.

Can Corporate Taxation Cut Your Llc Tax Bill?

- Some, such as virtual controllers, CFOs and CPAs, provide high-level accounting services like internal audits and financial planning and analysis.

- Some software solutions, however, don’t include both accounts payable and accounts receivable information.

- You need accounting software that tracks the money moving in and out of your business, with both accounts payable and accounts receivable features.

The automation features of MYOB Essentials for invoicing, payroll, and expense tracking can reduce the amount of paperwork your company has to deal with on a daily basis. If you are looking for a platform that will boost collaborations, Sage Business Cloud Accounting also has solutions for you. It comes with an accountant access tool that enrolls your consultants in the system and views your financial statements. The only drawback to this platform is that it might be too basic for high-growth businesses and large enterprises that deal with more complicated accounting responsibilities. Tipalti is a payment management software that allows you to optimize the processing of global payables by providing you with end-to-end control over your AP workflow.

Tradogram is a powerful cloud-based solution built primarily for businesses that need to automate the purchasing process end-to-end. With Tradogram, businesses of all sizes implement cost-effective procurement management, bringing all aspects that impact the bottom line under control. It enables decision-makers to streamline all communications related to purchasing, control costs, manage suppliers, and monitor expenses, all without compromising the quality of service.

Ways Time Tracker Apps Can Improve Your Work Life

Similar to Xero, QuickBooks, and other QuickBooks alternatives, Wave allows you to connect all your bank and credit card accounts so you can easily download transactions into your Wave account. The one drawback of this feature is that only the administrative user has access to the bank https://www.bookstime.com/ account details, which means that your bookkeeper won’t be able to reconcile the bank and credit card accounts. Similar to Wave, Sunrise, and ZipBooks, Xero allows unlimited users in all three of their pricing plans. This is a feature that QuickBooks does not offer at this time.

Newly formed LLCs may not officially begin operating as a business for a year or more, and older LLCs may slowly become irrelevant without being properly dissolved. LLCs that have become inactive or have no income may still be mandated to file a federal income tax return. An LLC may be taxed as a corporation or partnership, or it may be totally disregarded as an entity with no requirement to file.

How much does an LLC cost yearly?

In rare cases, QuickBooks may offer more than necessary, but in most, QuickBooks is better for business financial management than Quicken. If you are looking solely for your business, QuickBooks is clearly the best option of the two, but there are many other online accounting options to choose from as well.

It is possible to do minimal setup and then jump into creating invoices, paying bills, and accepting payments. You just have to decide whether you want to spend the time upfront building your records or take time out when you’re in the middle of sales or purchase forms. Once you have completed a customer record and started creating invoices, sending statements, and recording billable expenses, all of those actions will appear in a history within the record itself. One of the really great things about using a small business accounting tool is that it reduces repetitive data entry.

This can make your bank balance show you have more available cash than you actually 1800accountant pricing do. Like Wave, FreshBooks does not have accounts payable functionality.

Hobbies As A Business

Also known as the Wage and Tax Statement, Form W-2 is a document sent out by employers to both an employee on their payroll, and to the IRS. The Form reports the annual wages and taxes withheld on an employee’s paycheck. Let one of our assets = liabilities + equity financial experts prepare your taxes so you can spend your valuable time on other things. If you’re a freelancer or contractor, or you own and operate a small business, the IRS requires that you pay Estimated Taxes four times a year.

Recent Comments