Factors Affecting the Cost of Goods Sold

Is Cost of goods sold the same as cost of sales?

Cost of sales, also known as the cost of revenue, and cost of goods sold (COGS), both keep track of how much it costs a business to produce a good or service to be sold to customers. Both the cost of sales and COGS include the direct costs associated with the production of a company’s goods and services.

Occasionally, COGS is damaged down into smaller classes of prices like materials and labor. This equation seems at the pure dollar amount of GP for the company bookkeeping, but many times it’s helpful to calculate the gross revenue fee or margin as a proportion.

It excludes oblique bills, similar to distribution costs and sales force costs. Both the whole sales and price of goods bought are found on the revenue statement.

It additionally consists of the price of paying the employees who make the product. In some circles, the price https://cryptolisting.org/ of items bought is also known as value of income or value of sales.

Cost of products bought method

Notably, the cost of items bought is the sum of different costs which are incurred within the product and promoting processes of merchandise of a corporation. Bookkeeping ideas have been defined for recording and summarizing the gross income and cost of goods sold.

What is cost of goods sold in QuickBooks?

Costs of Goods Sold, or COGS, tracks all of the costs associated with the items you sell, which allows you to calculate gross profits accurately. COGS accounts also give the total underlying costs on your Profit & Loss reports. In QuickBooks, you create new accounts through the Chart of Accounts, or COA, window.

What Affects Gross Profit & Cost Of Goods Sold?

Cost of goods sold (COGS) is a vital line item on an revenue assertion. It displays https://cryptolisting.org/blog/how-do-i-write-off-previous-outstanding-checks the price of producing a good or service on the market to a buyer.

When should I use cost of goods sold?

Cost of goods sold is the direct costs tied to the production of a company’s goods and services. COGS excludes indirect expenses such as distribution costs and sales force costs. COGS represents the business expenses that are directly incurred because a transaction has taken place. Labor directly tied to production.

Instead, most of their prices will present up under a different part of the revenue assertion referred to as promoting, general and administrative expenses (SG&A). Cost of goods offered (COGS) refers to the direct prices of producing the goods offered by an organization. This quantity contains the cost of the supplies and labor immediately used to create the great.

- When calculating the cost of goods offered, don’t embody the price of creating items or companies that you just don’t sell.

- However, essentially, there’s almost no distinction between an organization’s listed value of products offered (COGS) and value of gross sales.

- View your Chart of Accounts and look for an account with a “Type” of Cost of Goods Sold.

- Subtract COGS, leaving a determine called the gross revenue or gross margin.

- Cost of Goods Sold is an EXPENSE item with a standard debit stability (debit to increase and credit score to decrease).

- Where the market value of goods has declined for no matter reasons, the enterprise might select to worth its inventory at the decrease of cost or market worth, also called web realizable value.

Product pricing, therefore, can have a dramatic impression on profitability at each degree, including gross profit and EBITDA. Cost of products soldis the direct prices tied to the production of a company’s goods and providers.

Payroll may be either sort of expense depending on the labor involved. Office payroll, for instance, would possibly include a secretary, an accountant, advertising specialists or janitorial workers who could be operating expenses. However, an meeting-line auto worker can be directly tied to production and would probably be included under costs of goods bought.

Cost of goods made by the enterprise

In addition, cost of products sold doesn’t embody oblique costs that cannot be attributed to the production of a specific product, like promoting and transport costs. Similarly, it means that the upper the COGS, the lower the gross profit margin. If the COGS exceeds whole sales, an organization may have a negative gross revenue, which means it is dropping cash over time and also has a adverse gross profit margin. She buys machines A and B for 10 each, and later buys machines C and D for 12 each. Under specific identification, the cost of goods offered is 10 + 12, the particular costs of machines A and C.

COGS excludes indirect bills similar to distribution costs and gross sales force prices. Another in style use of items in QuickBooks is for Cost of Goods Sold (COGS). Costs that are immediately related to the product are called Cost of Goods Sold (COGS). Costs of Goods Sold embrace the price of material, labor, subcontractors, and transport. The cost of products bought per dollar of gross sales will differ relying upon the type of enterprise you personal or in which you purchase shares.

What do you credit for cost of goods sold?

Cost of goods sold is the inventory cost to the seller of the goods sold to customers. Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease).

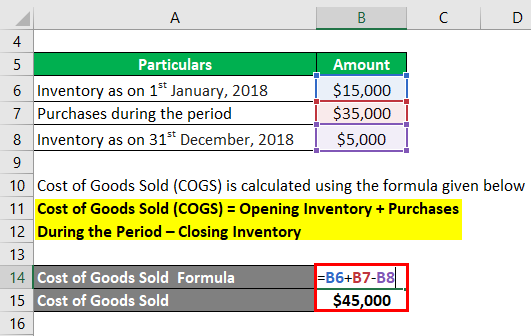

Calculating COGS

At the top of the year, the merchandise that weren’t bought are subtracted from the sum of starting stock and additional purchases. The last number derived from the calculation is the cost of goods sold for the 12 months. Gross revenue is the difference between gross sales and price of products sold. This financial metric is an effective indicator of the company’s working effectivity. Gross profit is affected by a number of objects that have to be intently monitored by managers.

Because COGS is a cost of doing enterprise, it’s recorded as a enterprise expense on the income statements. Knowing the price of items offered helps analysts, investors, and managers estimate the corporate’s bottom line. While this motion is beneficial for income tax functions, the enterprise will have less profit for its shareholders. Businesses thus attempt to keep their COGS low so that internet earnings might be greater. Inventory that is bought seems within the earnings assertion beneath the COGS account.

If she uses average price, her costs are 22 ( (10+10+12+12)/four x 2). Thus, her revenue for accounting and tax functions https://en.wikipedia.org/wiki/Boilerplate_code may be 20, 18, or sixteen, relying on her stock technique.

The beginning stock for the yr is the inventory left over from the earlier 12 months—that’s, the merchandise that was not sold within the previous year. Any extra productions or purchases made by a manufacturing or retail firm are added to the start inventory.

Traking COGS Percentage

The IRS allows for COGS to be included in tax returns and may scale back your business’s taxable revenue. Whether you are What is an Invoice and is it a Legal Document? a traditional retailer or a web-based retailer, the identical guidelines apply.

Recent Comments